foreign gift tax uk

A foreign gift does not include amounts paid for qualified tuition or medical payments made on behalf of the US. 1 And some countries without a gift tax per se have a deemed disposition tax or an income tax on gifts which is essentially a tax on accrued capital gains in the assets being gifted.

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Her father wants to gift her a considerable sum of money a six figure sum.

. There are no UK taxes or restrictions on gifts from abroad but there may be in the country of origin. You can carry any unused annual exemption forward to the next tax year -. Tax rates and exemptions are the same for nationals and foreign residents as well as for non-residents with property in the UK.

Is not unique in taxing donors on their gifts. Broadly speaking gifts to EEA charities qualify for UK tax relief whereas gifts to non-EEA foreign charities do not. You can be subject to a penalty equal to 5 but not to exceed 25 of the amount of the foreign gift or bequest if youre required to file Form 3520 but fail to do so.

Instead of a cash gift lets say Michelles parents gifted her a 500000 foreign investment account. IHT will only be payable if the value of the asset gifted to the trust exceeds the 325000 nil rate band. If a UK domiciled individual transfers an asset into a trust there will be an immediate lifetime inheritance tax charge at a rate of 20.

One of my clients is married to a woman who holds dual nationality country of birth outside the EU and UK when she would be deemed resident. Cash Gift from Abroad to UK Resident. Typically inheritance tax is paid by the executor using funds from the estate of the deceased.

Person receives one or more gifts from a Foreign Person individual entity or trust the recipient may have to report the value to the IRS. Sometimes known as death duties. This assumes he or she is non-UK domiciled as well as non-UK resident.

The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. Inheritance tax is the tax which is paid on an estate when the owner of that estate diesDepending on certain criteria the tax may also be payable on gifts or trusts made during that persons life. Gifts to foreign citizens are subject to the same rules governing any gift that a US.

While foreign gift tax may not be due by the donee a foreign person gift does have a disclosure requirement to the IRS if it exceeds certain thresholds. The EEA comprises the Member States of the EU plus Iceland Norway and Liechtenstein. In respect of the donor from a UK perspective a gift of cash or any other asset other than certain UK assets for example UK real estate will NOT create a CGT liability.

Hi HMRC Having gone through the various queries posted on the forum here I understand that money received as gift from abroad non-domiciled donor is not taxable in. If a gift exceeds the annual exclusion amount which is. 13 April 2016 at 938.

For Foreign Gift or Foreign Inheritance Issues. Inheritance Tax IHT is paid when a persons estate is worth more than 325000 when they die - exemptions passing on property. Foreign Gifts and Bequests.

For purposes of federal income tax gross income generally does not include the value of property acquired by gift bequest devise or inheritance. Gifts from Foreign Person IRS Reporting. Even though there are no US.

Any Estate and Gift Tax program employee considering any contact or exchange with a foreign tax official must contact EOI for guidance. Person a foreign person that the recipient treats as a gift or bequest and excludes from gross income. The standard rate for inheritance tax in the UK is 40.

Procedural and legal authority for the exchange of information with foreign partners is found primarily within IRM 4601121 Authority - Disclosure Confidentiality and Contacts with Foreign Tax Officials. Therefore there is no income tax on the foreign gift. You can give gifts or money up to 3000 to one person or split the 3000 between several people.

Gifts From Foreign Person IRS Reporting. Furthermore there is no donations tax payable on donations from a foreign resident to a SA resident provided the funds donated is from a. Making cash gifts to foreign citizens.

There are different threshold requirements for reporting depending on the value of gift and who makes the gift. Basically the disclosure of your foreign gift or inheritance on the Form 3520 is applicable if you. 5 per month up to a maximum penalty of 25 of the 100000 amount of unreported foreign gifts andor unreported foreign inheritances also called foreign bequests for failure to report the gift or inheritancebequest on Form 3520 Part IV.

At present entities of a charitable nature established in these countries are effectively recognised as charities for UK tax purposes. Many other countries tax their residents on gifts with rates as high as 50. Your bank may seek information on the source of the funds as part of their anti money laundering procedures.

This includes foreign persons. Posted 20 days ago by Vish. What are the tax implications on both the inheritance and on the transfer of money into the UK and on the money that will be donated to my son.

This charge is calculated on the value of the asset transferred. In general a foreign gift or bequest is any amount received from a person other than a US. The donor might have to consider UK IHT if the cash he has gifted is within.

Person who receives foreign gifts that exceed certain threshold amounts during the taxable year must report the gifts on a Form 3520. Donations tax is payable by the donor and not the recipient - therefore there are no tax implications for you however you need to disclose it in your tax return ITR12 as an amount not considered taxable. Tax ramifications on the initial receipt of a gift from a foreign person although usually an IRS Form 3520 is required the lack of reporting of the foreign gift on behalf of the US.

That account generates 20000 a year in income. Income Tax on Foreign Gift Income. Rates and reductions on inheritance tax in the UK.

1 However a US. He is born and resides outside the EU and holds no ties to the UK. However only a small percentage of estates between 4 and 5 are large enough to incur inheritance tax.

Person recipient may lead to. You also might be subject to a penalty if you file the form but its incomplete or inaccurate. Received more than 100000 from a non-resident alien individual or a foreign estate.

2 Others may have pull-back provisions in the event the donor passes. Penalties for Not Timely Filing.

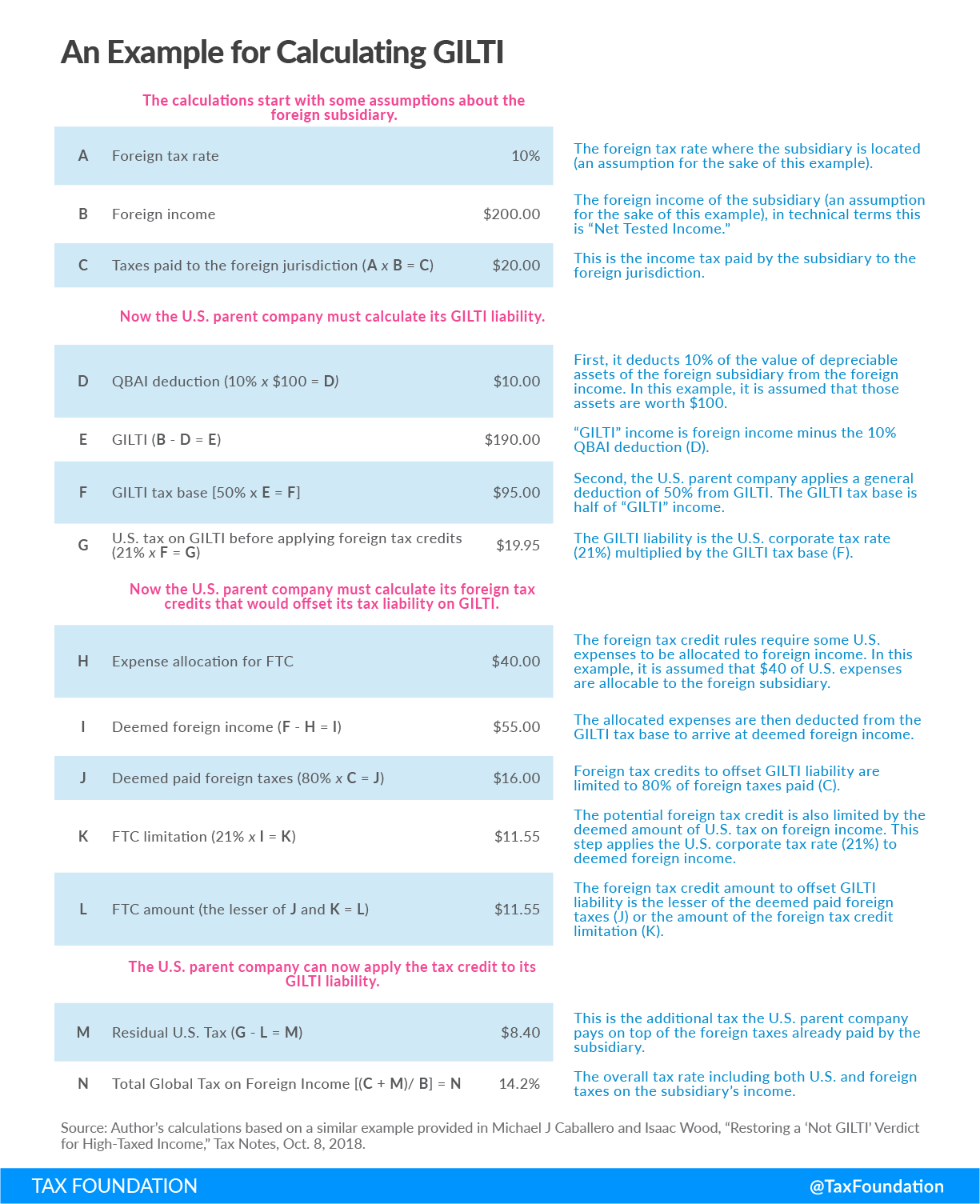

Global Intangible Low Tax Income Definition Tax Foundation

Us Taxes Preparation Uk Is Something That You Should Give Importance To Now Us Tax Tax Preparation Tax Help

Have You Received An Irs Notice Of Intent To Levy Irs Intentions Offshore

What S The Difference Between An Nro Account And An Nre Quora Accounting Helpful Hints Dividend Income

Global Intangible Low Tax Income Definition Tax Foundation

What Are The Consequences Of The New Us International Tax System Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

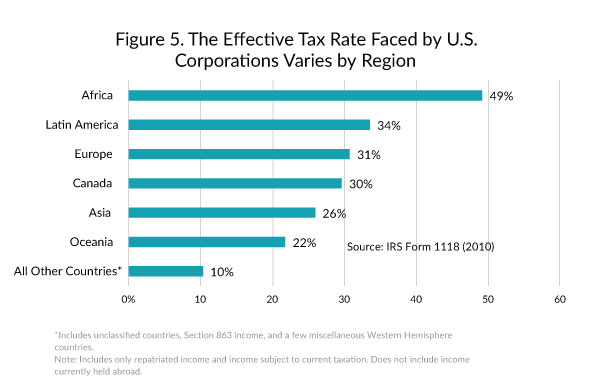

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

The Foreign Tax Credit International Tax Treaties Compliance

Foreign Tax Credits Of The Income Tax Toronto Tax Lawyer

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Pin On Dominca Citizenship By Investment

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Understanding Tcs On Foreign Remittance The Financial Express

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation